Determining and structuring long-term compensation plans is a complex, multi-year process for boards that is constantly evolving. Compensation plans have many objectives measured over a multi-year time horizon, including:

- Ensuring that compensation decisions are highly correlated to long-term performance.

- Enhancing the alignment of interests between executives and shareholders.

- Mitigating the risk of unintended outcomes or the creation of inappropriate incentives.

- Attracting, motivating and retaining top talent.

The focus of the following principles is on “pay for performance” and the integration of risk management functions into the executive compensation philosophy and structure.

While proxy disclosure is limited to the top five executives, boards are expected to ensure these principles are used in determining compensation practices throughout the company. The compensation programs for senior executives set the tone and should reflect a company’s overall compensation philosophy and risk profile.

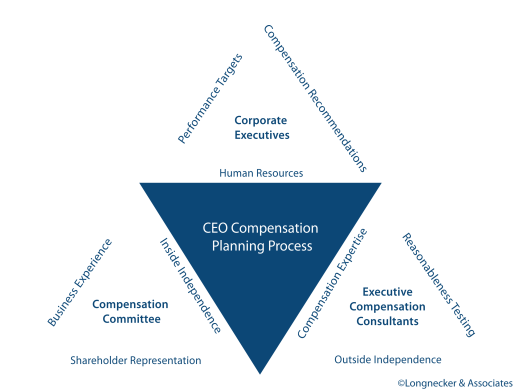

The board and the compensation committee of every public company are responsible for, and accordingly must be actively involved in, establishing and independently verifying compensation philosophy, setting performance measures and assessing performance.

The Canadian Coalition for Good Governance (CCGG) recognizes next 6 principles as the Key of the Executive Compensation. Totally agree with them.

- PRINCIPLE 1

A significant component of executive compensation should be “at risk” and based on performance.

- PRINCIPLE 2

“Performance” should be based on key business metrics that are aligned with corporate strategy and the period during which risks are being assume.

- PRINCIPLE 3

Executives should build equity in the company to align their interests with those of shareholders.

- PRINCIPLE 4

A company may choose to offer pensions, benefits and severance and change-of-control entitlements. When such perquisites are offered, the company should ensure that the benefit entitlements are not excessive.

- PRINCIPLE 5

Compensation structure should be simple and easily understood by management, the board and shareholders.

- PRINCIPLE 6

Boards and shareholders should actively engage with each other and consider each other’s perspective on executive compensation matters.

Borja Burguillos